Upcoming Meetings

April 30, 2024 - 9:00am

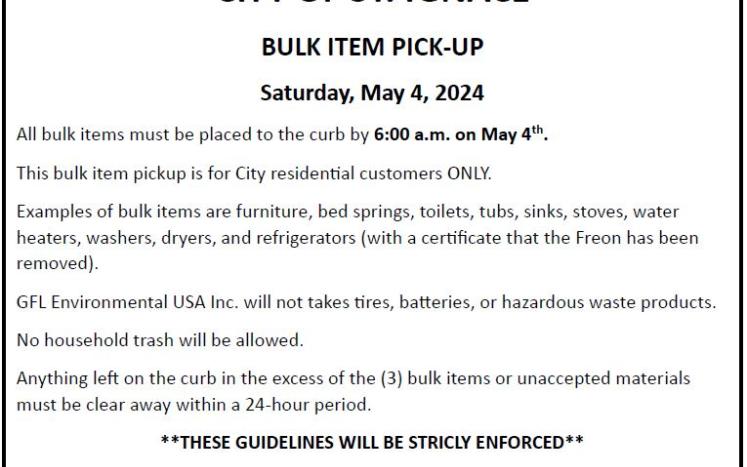

May 4, 2024 - 6:00am

May 6, 2024 - 7:00pm

May 10, 2024 - 8:00am

May 14, 2024 - 7:00pm

May 20, 2024 - 7:00pm

2023 Water Quality Report »

Hard Copies of the 2023 Water Quality Report are available at City Hall